Contents

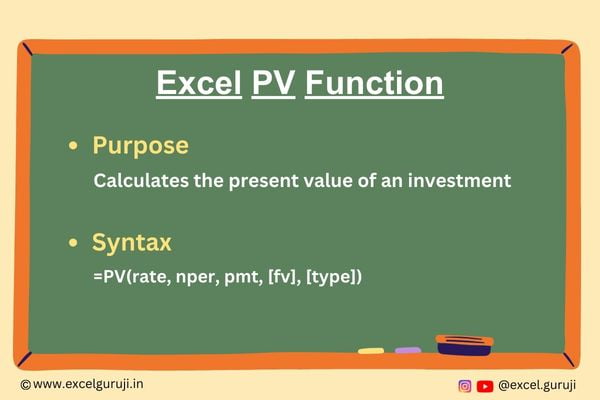

Excel PV Function

When to Use the Excel PV Function in Excel

The Excel PV function1 is used to calculate the present value of an investment or a series of cash flows, considering a specified interest rate and time period. This function is particularly useful in financial modeling, valuation analysis, and decision-making processes.

What Excel PV Function Returns

The Excel PV function returns the present value of an investment based on a series of future cash flows.

Syntax of Excel PV Function

The syntax of the Excel PV function is as follows:

=PV(rate, nper, pmt, [fv], [type])

Input Arguments

Here are the input arguments for the Excel PV function:

● rate: The interest rate per period, representing the discount rate applied to future cash flows.

● nper: The total number of payment periods, indicating the investment’s duration.

● pmt: The payment made each period, which remains constant throughout the investment’s duration.

● [fv]: The future value or cash balance that you aim to attain after the last payment. This argument is optional, and if omitted, it is assumed to be 0.

● [type]: A numeric value (0 or 1) indicating when payments are due. If omitted, it is assumed to be 0. If 0, payments are due at the end of the period; if 1, payments are due at the beginning of the period.

Examples of the Excel PV Function

Here are few examples demonstrating the usage of the Excel PV function:

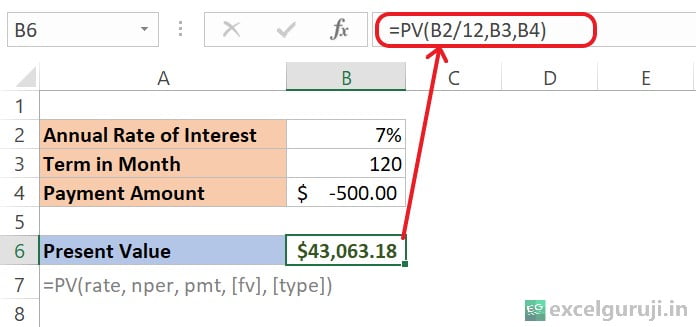

Example 1: Basic Usage

Imagine you are regularly adding money to save for retirement. You put in $500 every month, and with an 7% interest rate, you plan to continue this for 10 years, making a total of 120 monthly contributions.

Let’s break down the formula: =PV(B2/12,B3,B4)

- B2/12: The annual rate of interest is in cell B2, and it is divided by 12 to convert it to a monthly interest rate.

- B3: The term in months is in cell B3, representing the total number of payment periods or the duration of the investment.

- B4: The payment amount is in cell B4, and it is negative because it represents an outgoing payment (a regular contribution or investment).

- Present Value (PV): The calculated present value of the investment based on an annual interest rate of 7%, a term of 120 months, and monthly payments of $500.00.

This means that, given the parameters, the present value of the future cash flows (monthly payments) at a 7% annual interest rate over 10 years is estimated to be $43,063.18.

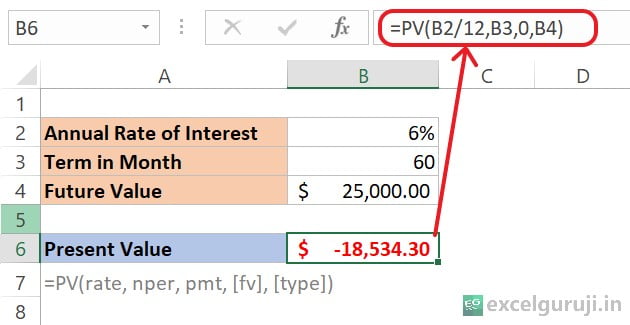

Example 2: Investment Based on Future Value

To determine the current investment needed to reach a goal of $25,000 in 5 years, with an annual interest rate of 6%. The goal is to find out how much money needs to be invested today to achieve the desired amount by the end of the investment period.

Let’s break down the formula: =PV(B2/12,B3,0,B4)

- B2/12: The interest rate per period. The annual interest rate is divided by 12 to convert it to a monthly rate.

- B3: The total number of payment periods or the duration of the investment, which is 60 months in this case.

- 0: The payment made each period. In this scenario, there is no regular payment; it’s set to 0.

- B4: The future value or cash balance that you aim to attain after the last payment, which is $25,000.00.

The result of this formula is approximately $-18,534.30. The negative sign indicates that you would need to invest approximately $18,534.30 today to achieve a future value of $25,000.00 after 60 months, considering a 6% annual interest rate.

Note: We have only covered the use of the [fv] optional argument here; we won’t delve into much detail. If you want to learn more, check out our PMT function. It has detailed examples and explanations for optional arguments.

Extra Notes

● If there is no future value, make sure to include a pmt, and vice versa.

● Ensure that the units for rate and nper are consistent (both annual or both monthly).

● Just remember, negative numbers show money going out, and positive numbers show money coming in.

● When any of the given values are not numbers, you will get a #VALUE! error.

● If the Excel PV Function result is way higher or lower than expected, double-check that you are using the right units for each argument.

Practice Workbook

There are two sheets in practice file

Download Free Excel File For PracticeConclusion

In conclusion, the Excel PV function is an indispensable tool for financial analysts, investors, and anyone involved in evaluating the present value of future cash flows. Whether you are assessing investment opportunities, conducting financial planning, or analyzing the profitability of projects, the PV function provides valuable insights.

Take the time to understand the nuances of the PV function and its input parameters, as accurate financial assessments hinge on precise calculations. By mastering the PV function, you empower yourself to make informed decisions and enhance your financial modeling skills.

Frequently Asked Questions (FAQs)

Q1: Can the PV function handle varying cash flows over time?

A1: Yes, the PV function is versatile and accommodates varying cash flows as long as the payments are consistent within each period.

Q2: What happens if the rate is negative in the PV function?

A2: The rate should be positive, as it represents the discount rate. A negative rate may lead to unexpected results.

Q3: Can the PV function be used for loan calculations?

A3: Yes, the PV function is commonly used in loan calculations to determine the present value of future repayments.

Q4: Is the PV function affected by the currency used in the cash flows?

A4: No, the PV function is currency-neutral, and you can use it with any currency as long as the units are consistent.

Q5: Are there any alternative functions to PV for present value calculations?

A5: While PV is widely used, there are other functions like NPV (Net Present Value) that can be employed for similar calculations, particularly in more complex financial models.

Click here to download the free Mortgage Calculator Template (With Extra Payment)

Other Related Excel Functions

Excel Mastery: Unveiling the Secrets of the Excel PPMT Function for Precise Principal Payments

Join me on Instagram, YouTube and WhatApp Channel for your daily dose of valuable tips and tricks! Catch insightful videos that will enhance your knowledge and skills. Don’t miss out – follow me now!