Contents

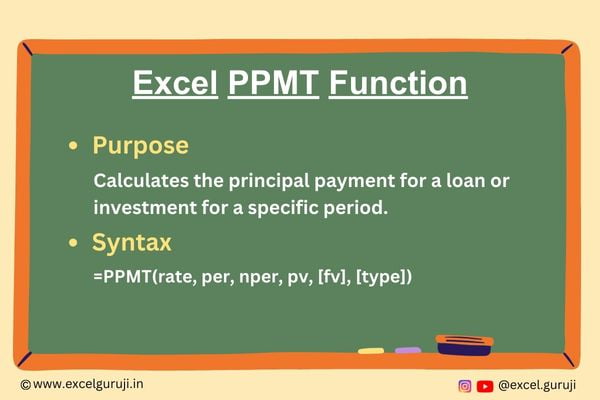

Excel PPMT Function

When to Use the Excel PPMT Function in Excel

The PPMT function1 in Excel comes in handy when you need to calculate the principal payment for a specific period of a loan or investment. It is particularly useful in financial scenarios where you want to understand how much of your payment goes towards repaying the principal amount.

What Excel PPMT Function Returns

The Excel PPMT function returns the principal payment for a given period based on a fixed interest rate and constant payments.

Syntax of Excel PPMT Function

The syntax of the Excel PPMT function is as follows:

=PPMT(rate, per, nper, pv, [fv], [type])

Input Arguments

Here are the input arguments for the Excel PPMT function:

● rate: The interest rate for each period.

● per: The specific period for which you want to find the principal payment.

● nper: The total number of payment periods.

● pv: The present value, or the total amount of the loan or investment.

● [fv]: (Optional) The future value or cash balance after the last payment. If omitted, it is assumed to be 0.

● [type]: (Optional) The timing of the payment. (0 for the end of the period, 1 for the beginning). If omitted it will take 0 by default

Examples of the Excel PPMT Function

Here are few examples demonstrating the usage of the Excel PPMT function:

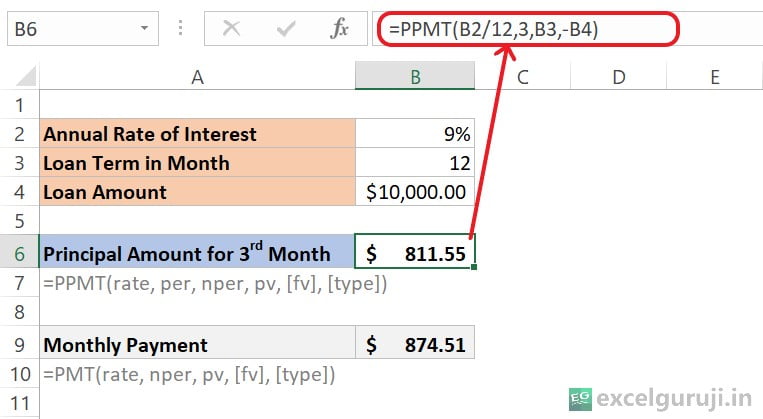

Example 1: Calculating the Principal Amount of a Loan for a Specific Month

Assuming you have a loan with an annual interest rate of 9%, a total of 12 monthly payments, and the present value of the loan is $10,000. To find the principal payment for the third month, use the following formula:

Let’s break down the formula: =PPMT(B2/12,3,B3,-B4)

- B2/12: This part calculates the monthly interest rate. Since the annual interest rate is 9%, dividing it by 12 gives the monthly interest rate.

- 3: This is the period or month for which we want to calculate the principal payment. In our case, it is the 3rd month.

- B3: This represents the total number of payment periods, which is the loan term in months.

- -B4: This is the present value or loan amount. The negative sign indicates that it is an outgoing payment.

The result, $811.55, represents the principal portion of the monthly payment for the 3rd month. The normal EMI (monthly payment) is $874.51, and the difference between the EMI and the PPMT result is likely the interest portion of the payment for the 3rd month.

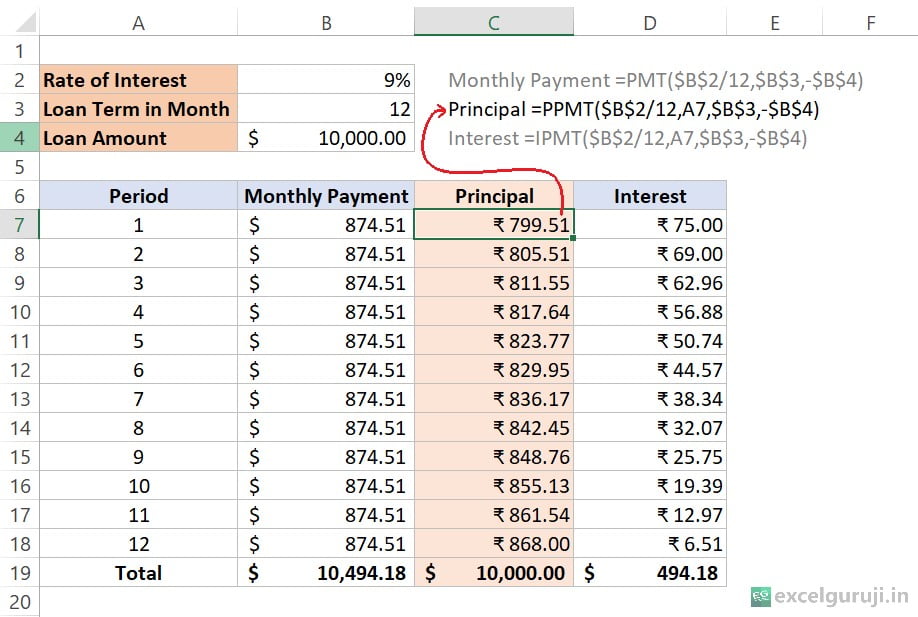

Example 2: Calculating the Principal Amount of a Loan for Each Month.

In this example, we will utilize the same parameters as in Example 1.

Let’s break down the formula: =PPMT($B$2/12,A7,$B$3,-$B$4)

- $B$2/12: This part calculates the monthly interest rate. Since the annual interest rate is 9%, dividing it by 12 gives the monthly interest rate. The dollar signs indicate absolute references, ensuring that the cell references don’t change when we copy the formula to other cells.

- A7: This represents the period or month for which we want to calculate the principal payment.

- $B$3: This is the total number of payment periods, which is the loan term in months. It is an absolute reference.

- -$B$4: This is the present value or loan amount. The negative sign indicates that it is an outgoing payment. It is an absolute reference.

The Monthly Payment and Interest columns in the table represent the overall monthly payment and the interest portion, respectively. The sum of the Principal column should match the total loan amount, and the sum of the Interest column should represent the total interest paid over the loan term.

Note: We won’t go into optional argument details here. If you want to learn more, check out our PMT function. It has detailed examples and explanations for optional arguments.

Extra Notes

● Ensure that the units for rate and nper are consistent (both annual or both monthly).

● If the interest rate is less than or equal to -1 or the number of payment periods is 0, you will see a #NUM! error.

● When any of the given values are not numbers, you will get a #VALUE! error.

● To know the total paid over the loan time, just multiply the PMT amount by the number of payments (nper).

● If the Excel PPMT Function result is way higher or lower than expected, double-check that you are using the right units for interest rate and number of periods. Make sure to convert annual rates to monthly or quarterly rates, and years to weeks, months, or quarters, as shown in previous examples.

Practice Workbook

There are two sheets in practice file

Download Free Excel File For PracticeConclusion

In conclusion, the Excel PPMT function is an invaluable tool for financial analysis, allowing users to dissect loan or investment payments into principal and interest components. Whether you are managing loan repayments or assessing investment returns, the Excel PPMT function can provide essential insights into your financial commitments.

As with any Excel function, practice is key to mastering its usage. Experiment with different scenarios and financial parameters to enhance your understanding of the Excel PPMT function. Start incorporating the Excel PPMT function into your financial analyses today and elevate your Excel proficiency to new heights!

Frequently Asked Questions (FAQs)

Q1: Can the Excel PPMT function be used for investments with irregular payment schedules?

A1: No, the Excel PPMT function assumes regular and constant payment periods.

Q2: What happens if the specified period (per) exceeds the total number of payment periods (nper)?

A2: In such cases, the function will return an error as there is no payment information for the specified period.

Q3: Is the PPMT function affected by changes in the interest rate during the loan term?

A3: No, the PPMT function assumes a constant interest rate throughout the loan term.

Q4: Can the PPMT function handle loans with varying payment frequencies?

A4: No, the PPMT function is designed for regular and consistent payment periods.

Q5: What is the key difference between the PPMT and IPMT functions?

A5: The PPMT function calculates the principal payment, while the IPMT function calculates the interest payment for a specific period.

Click here to download the free Mortgage Calculator Template (With Extra Payment)

Other Related Excel Functions

Excel PMT Function Mastery: A Comprehensive Guide to Financial Planning

Join me on Instagram, YouTube and WhatApp Channel for your daily dose of valuable tips and tricks! Catch insightful videos that will enhance your knowledge and skills. Don’t miss out – follow me now!