Contents

Excel IRR Function

When to Use the Excel IRR Function in Excel

The IRR (Internal Rate of Return) function1 in Excel is a powerful tool used for evaluating the profitability of an investment by calculating the rate of return at which the net present value (NPV) of cash flows becomes zero.

What Excel IRR Function Returns

The Excel IRR function returns the internal rate of return for a series of cash flows.

In every calculation, it is inherently assumed that:

- Uniform time intervals exist between each cash flow.

- All cash inflows and outflows take place at the conclusion of each period.

- Earnings produced by the project are reinvested at the internal rate of return.

Syntax of Excel IRR Function

The syntax of the Excel IRR function is as follows:

=IRR(values, [guess])

Input Arguments

Here are the input arguments for the Excel IRR function:

● values: The cash flow values representing the investment or project. These values can be a series of cash inflows and outflows and must include at least one negative (outflow) and one positive (inflow) value.

● guess: An optional argument representing the initial guess for the internal rate of return. It is recommended to provide a reasonable guess to ensure accurate results. If omitted, Excel assumes a default value of 0.1 (=10%)

Examples of the Excel IRR Function

Here are few examples demonstrating the usage of the Excel IRR function:

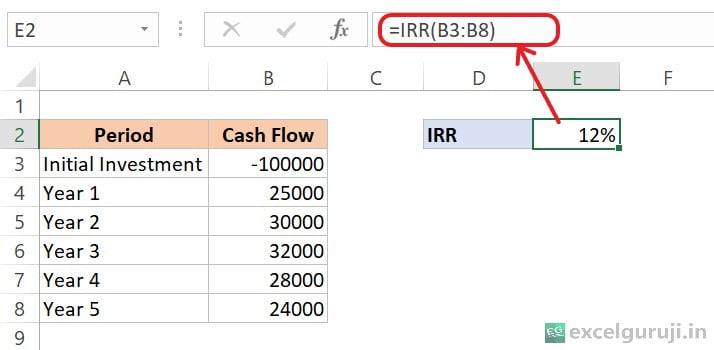

Example 1: Basic Usage

Suppose you have a series of cash flows for an investment in cells B3 to B8. To calculate the internal rate of return, use the following formula:

The “=IRR(B3:B8)” formula calculates the Internal Rate of Return (IRR) for a given set of cash flows. The initial investment (Year 0) is negative, representing an outgoing cash flow, while subsequent years are positive for incoming cash.

The IRR function determines the interest rate at which the present value of cash inflows equals the initial investment, resulting in a balanced net present value.

In this case, the IRR is 12%, indicating that if discount future cash flows at this rate, the present value will be zero. This 12% is the internal rate of return, representing the expected annualized return on the investment.

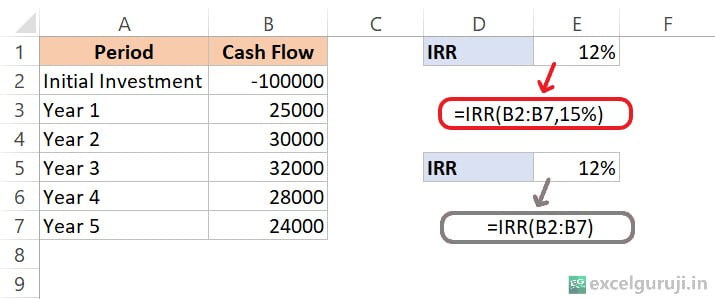

Example 2: Specifying an Initial Guess

If the initial guess is known or estimated, it can be included in the formula. For instance:

As demonstrated in the example above, our initial estimation does not influence the outcome. However, in certain situations, altering the guessed value may lead the IRR formula to yield a different rate.

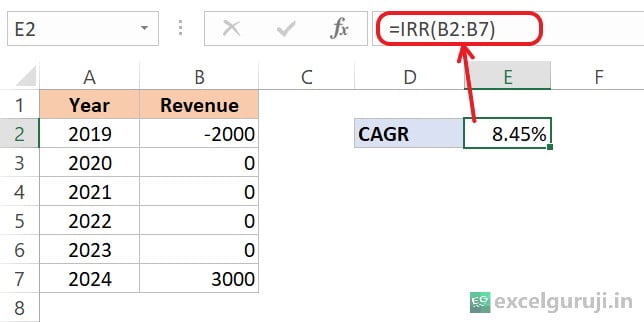

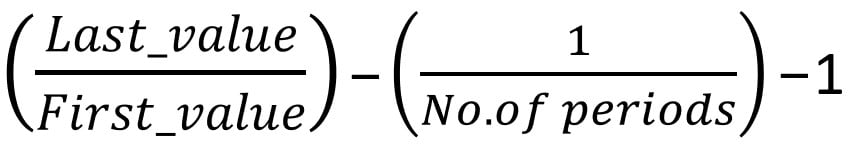

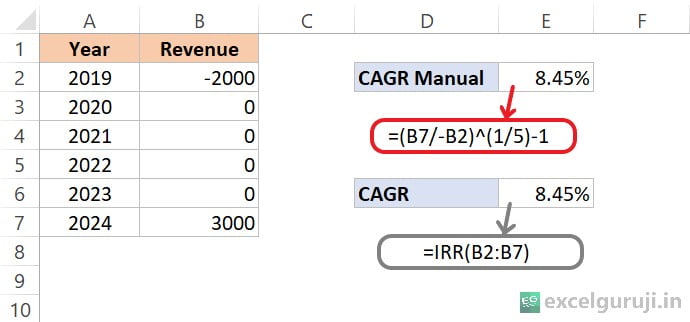

Example 3: Calculating CAGR with IRR

Although Excel’s IRR function is primarily use for internal return rate calculations, it can also use to calculate the compound annual growth rates (CAGR). To do this, simply restructure your original data as follows:

- Make the first value of your data negative and the last value positive.

- Put zeros for all the in-between cash flow.

Then, use this formula:

As demonstrated in the example above, our initial estimation does not influence the outcome. However, in certain situations, altering the guessed value may lead the IRR formula to yield a different rate.

To double-check if it is right, use this simple formula:

Look at the picture below; both formulas give you the same answer:

Extra Notes

● The IRR function may not always converge to a solution, especially if cash flows have unconventional patterns. In such cases, adjusting the initial guess can be helpful.

● Excel IRR function assumes that cash flows occur at regular intervals. If this is not the case, consider using the XIRR function, which accommodates irregular cash flow periods.

● The result of the IRR function is expressed as a percentage.

● If the IRR function encounters an error or does not converge, it returns the #NUM! error.

Practice Workbook

Download Free Excel File For PracticeConclusion

In conclusion, the Excel IRR function is an invaluable tool for financial professionals, analysts, and anyone involved in investment decision-making. By providing a measure of the potential profitability of an investment, the IRR function aids in assessing the attractiveness of different projects and financial opportunities.

As with any Excel function, it is crucial to understand the context of use and the specific requirements of your financial analysis. Experiment with different scenarios, cash flow structures, and initial guesses to master the application of the IRR function in various situations.

Frequently Asked Questions (FAQs)

Q1: Can the IRR function handle investments with irregular cash flow periods?

A1: The standard IRR function assumes regular intervals. For irregular cash flow periods, consider using the XIRR function.

Q2: Is there a limitation to the number of cash flows the IRR function can handle?

A2: Excel’s IRR function can handle a substantial number of cash flows, but extremely large datasets may impact performance.

Q3: What does a negative IRR indicate?

A3: A negative IRR implies that the investment is not expected to generate a positive return, and caution should be exercised in such cases.

Q4: Can the IRR function be used for projects with only one cash flow?

A4: Yes, the IRR function can be used for projects with a single cash flow, but it is more commonly applied to projects with multiple cash flows.

Q5: Is the IRR function affected by changes in interest rates?

A5: Yes, the IRR is sensitive to changes in interest rates, and fluctuations can impact the calculated rate of return.

Other Related Excel Functions

Excel Mastery: Unveiling the Secrets of the Excel PPMT Function for Precise Principal Payments

Join me on Instagram, YouTube and WhatApp Channel for your daily dose of valuable tips and tricks! Catch insightful videos that will enhance your knowledge and skills. Don’t miss out – follow me now!