Contents

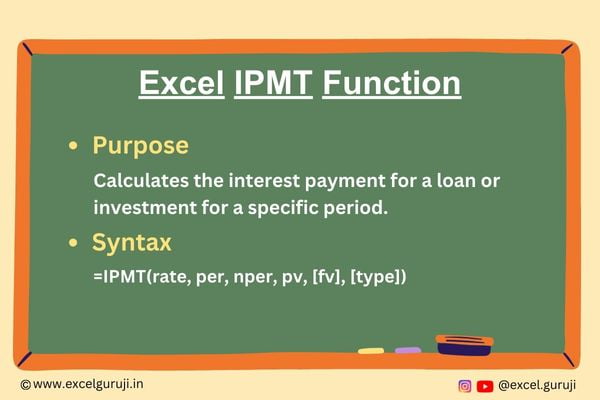

Excel IPMT Function

When to Use the Excel IPMT Function in Excel

The IPMT function1 in Excel proves invaluable when you need to calculate the interest payment for a specific period within a loan or investment. This function allows you to break down your overall payment into interest and principal components, providing crucial insights into your financial obligations.

What Excel IPMT Function Returns

The Excel IPMT function returns the interest payment for a given period based on a fixed interest rate and constant payments.

Syntax of Excel IPMT Function

The syntax of the Excel IPMT function is as follows:

=IPMT(rate, per, nper, pv, [fv], [type])

Input Arguments

Here are the input arguments for the Excel IPMT function:

● rate: The interest rate for each period.

● per: The specific period for which you want to find the interest payment.

● nper: The total number of payment periods.

● pv: The present value, or the total amount of the loan or investment.

● [fv]: (Optional) The future value or cash balance after the last payment. If omitted, it is assumed to be 0.

● [type]: (Optional) The timing of the payment. (0 for the end of the period, 1 for the beginning). If omitted it will take 0 by default

Examples of the Excel IPMT Function

Here are few examples demonstrating the usage of the Excel IPMT function:

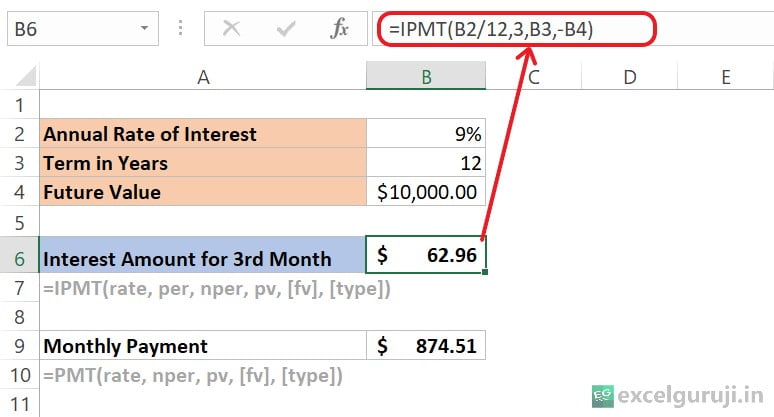

Example 1: Calculating the Principal Amount of a Loan for a Specific Month

Assuming you have a loan with an annual interest rate of 9%, a total of 12 monthly payments, and the present value of the loan is $10,000. To find the interest payment for the third month, use the following formula:

Let’s break down the formula: =IPMT(B2/12,3,B3,-B4)

- B2/12: This part calculates the monthly interest rate. Since the annual interest rate is 9%, dividing it by 12 gives the monthly interest rate.

- 3: This is the period or month for which we want to calculate the interest payment. In our case, it is the 3rd month.

- B3: This represents the total number of payment periods, which is the loan term in months.

- -B4: This is the present value or loan amount. The negative sign indicates that it is an outgoing payment.

The result, $62.96, represents the interest portion of the monthly payment for the 3rd month. The normal EMI (monthly payment) is $874.51, and the difference between the EMI and the IPMT result is likely the principal portion of the payment for the 3rd month.

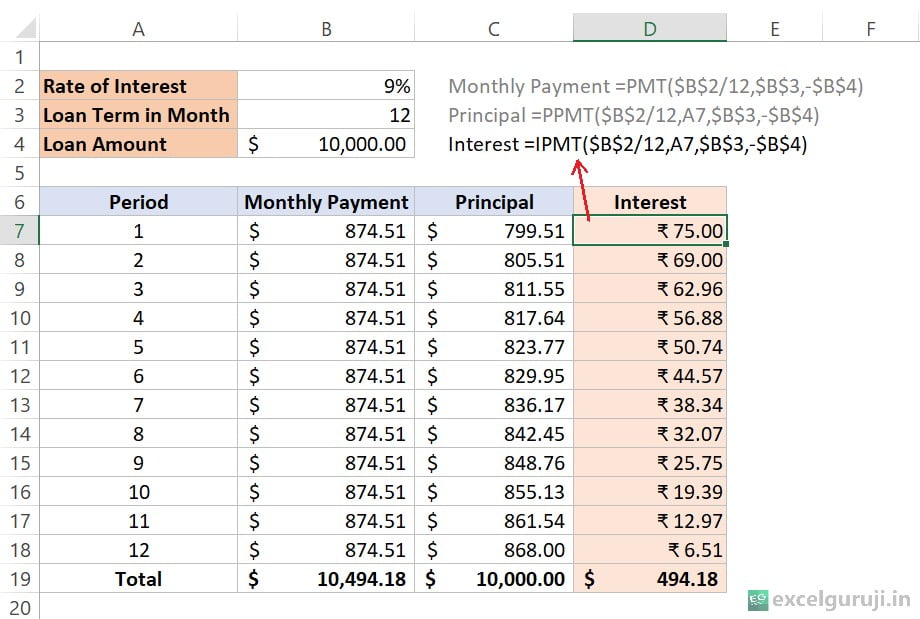

Example 2: Calculating the Interest Amount of a Loan for Each Month.

In this example, we will utilize the same parameters as in Example 1.

Let’s break down the formula: =IPMT($B$2/12,A7,$B$3,-$B$4)

- $B$2/12: This part calculates the monthly interest rate. Since the annual interest rate is 9%, dividing it by 12 gives the monthly interest rate. The dollar signs indicate absolute references, ensuring that the cell references don’t change when we copy the formula to other cells.

- A7: This represents the period or month for which we want to calculate the interest payment.

- $B$3: This is the total number of payment periods, which is the loan term in months. It is an absolute reference.

- -$B$4: This is the present value or loan amount. The negative sign indicates that it is an outgoing payment. It is an absolute reference.

The Monthly Payment and Principal columns in the table represent the overall monthly payment and the principal portion, respectively. The sum of the Principal column should match the total loan amount, and the sum of the Interest column should represent the total interest paid over the loan term.

Note: We won’t go into optional argument details here. If you want to learn more, check out our PMT function. It has detailed examples and explanations for optional arguments.

Extra Notes

● Ensure that the units for rate and nper are consistent (both annual or both monthly).

● If the interest rate is less than or equal to -1 or the number of payment periods is 0, you will see a #NUM! error.

● When any of the given values are not numbers, you will get a #VALUE! error.

● To know the total paid over the loan time, just multiply the PMT amount by the number of payments (nper).

● If the Excel IPMT Function result is way higher or lower than expected, double-check that you are using the right units for interest rate and number of periods. Make sure to convert annual rates to monthly or quarterly rates, and years to weeks, months, or quarters, as shown in previous examples.

Practice Workbook

There are two sheets in practice file

Download Free Excel File For PracticeConclusion

In conclusion, the Excel IPMT function is a powerful tool for financial analysis, allowing users to analyze interest payments within a loan or investment. Whether you are managing loan repayments or assessing investment returns, the IPMT function provides essential insights into your financial commitments.

As with any Excel function, practice is key to mastering its usage. Experiment with different scenarios and financial parameters to enhance your understanding of the Excel IPMT function. Start incorporating the Excel IPMT function into your financial analyses today and elevate your Excel proficiency to new heights!

Frequently Asked Questions (FAQs)

Q1: Can the Excel IPMT function be used for investments with irregular payment schedules?

A1: No, the Excel IPMT function assumes regular and constant payment periods.

Q2: What happens if the specified period (per) exceeds the total number of payment periods (nper)?

A2: In such cases, the function will return an error as there is no payment information for the specified period.

Q3: Is the IPMT function affected by changes in the interest rate during the loan term?

A3: No, the IPMT function assumes a constant interest rate throughout the loan term.

Q4: Can the IPMT function handle loans with varying payment frequencies?

A4: No, the IPMT function is designed for regular and consistent payment periods.

Q5: What is the key difference between the IPMT and PPMT functions?

A5: The IPMT function calculates the interest payment, while the PPMT function calculates the principal payment for a specific period.

Click here to download the free Mortgage Calculator Template (With Extra Payment)

Other Related Excel Functions

Excel PMT Function Mastery: A Comprehensive Guide to Financial Planning

Join me on Instagram, YouTube and WhatApp Channel for your daily dose of valuable tips and tricks! Catch insightful videos that will enhance your knowledge and skills. Don’t miss out – follow me now!